If you’re trying to find out what the hullabaloo about investing and the stock market is all about, then you need not look further than your own bank account. The main reason for why individuals who have a lot of cash which could have been safely tucked away in bank accounts invest their money in the stock market is because of inflation.

When inflation rates are higher than interest rates, the value of your money actually shrinks instead of you earning. While this can still change in the future, the fact of the matter is that inflation continues to kick interest rates’ rear and has been for a couple of decades running.

Making the Case for Investing

While the decision to invest seems like a very rational move given the information above, it’s always easier said than done. On the get go people worry about losing their money before they even begin investing. The general notion is that investing is only a glamorous form of gambling. While you may have to accept right now that your decisions can make you lose money in the same way that it may make you a fortune, investing involves making decisions based on sound techniques and methods.

Developing Your Own System

Of course, you’ll be funnelling money from your pockets into losing stocks without taking care of one important requisite in investing – preparation. For you to be well-prepared, you need to have a system of picking stocks that you’re comfortable with. Your method has to be completely personal and something which fits your own philosophy when it comes to investing. This involves how risky or conservative an investor you are.

Factors to Consider When Picking Stocks

When making your system in picking stocks, there are a couple of factors for you to consider:

On a company’s health. The quality of your investment is only as good as the health of the company whose stocks you have purchased. And because so many variables have to be considered when predicting how a certain company will fare, it’s virtually impossible for you to predict right at the very onset if you have a stable company on your hands or not.

On intangible aspects of a company. You may be able to quantitate how much a company makes and or how much a company loses. However, what about aspects such as the quality of a company’s staff, its advantages or its reputation? These aspects are completely subjective and make it difficult for a person to pick stocks.

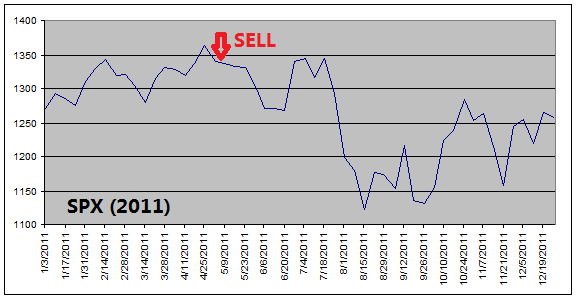

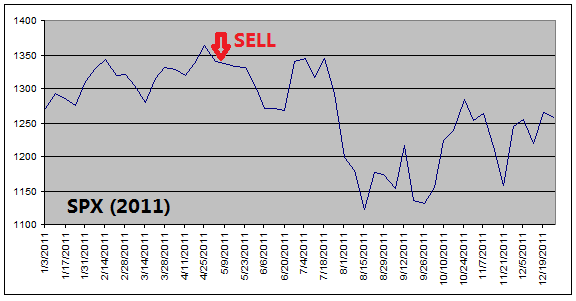

On human emotions. Nick Scali on twitter once mentioned that part of the volatility of the stock market is the emotions that come into play when trading. While you may be able to predict how a company will fare based on measurable variables, when human emotions come into play it becomes very difficult for stocks to perform the way that you had anticipated them to. Confidence can turn into fear in just a matter of minutes and this can completely overturn the way that the stock market is.

Carl Farell is a financial planner by profession and a regular contributor to investment blogs that cover wide array of personal finance topics such as mutual funds, stocks, insurances and savings.