Normally CRM in bank is a system designed to boost more efficient interactions with the clients during the whole cycle of communication between a client and a bank.

The main goal of CRM in banking is to attract new customers and strengthen the loyalty of the existing ones.

This goal can be realized through the whole sub-set of interim tasks addressing the fulfillment of all the elements, which are the constituents of the system:

- sales force management

- performance management

- document flow automation

- reports and analysis.

CRM in banks is definitely an irreplaceable tool for implementation and rollout of the following improvements:

- Establishment of contact-center. What does an effective contact center mean? Let’s imagine that a customer gives bank a call asking a non-standard question about some banking product. The very next day this customer gives a call to another operator, introduces himself and tells additional information about his previous request. If the contact center works effectively, the operator will quickly find all the history of the customer’s calls together with the notes about client’s demands. In case of customer support-center being insufficient, the operator makes the client tell the entire story from the very beginning as he simply doesn’t have any information about previous communication at hand.

- Attraction and development of individuals. Credit activities traditionally can be considered as the most complicated processes in banking sphere. CRM in banking is capable of controlling the entire process of consultations and finalization of the decision to provide a credit. The essential constituents of this process are generation of new clients (as well as up- and cross-selling) and retention of the existing ones (customer lifecycle management). Within the customer management framework, there’s also a stream responsible for handling matters with VIP-segment of individuals. The main functions of bank CRM for this stream are to remind clients of all important events, to present client’s parameters in a handy way, to analyze data presented in client’s profiles.

- Development of legal entities. During targeted business development, it’s critical to control activities of managers in the bank at every step of selling process. For this direction analysis of interrelations between legal entities (affiliated companies, subsidiaries etc.) is one of the key tasks. A client should be provided with the optimal product portfolio where all the history of interrelations with various subdivisions of the bank is considered.

- CRM for banks allows to arrange Soft/Medium/Hard Collection, Legal Collection processes as well as interaction with external collection agencies. The system controls sequences of tasks for various types of payment delays. It forms a package of documents for arbitration and tables of data sharing with collection agencies.

- Marketing, client database growth. Banks CRM are capable of controlling customer surveys and mail distributions as well as tracking effectiveness of client attraction.

How to choose the right CRM product

Among the variety of CRM systems for banks available on the software market it’s important to choose the one, which is more or less customized in accordance to the needs of the definite organization.

Below is the brief overview of several most popular CRM banking software:

Bpm’online

One of the leaders in CRM software presents great tool for bank sales and bank customers management system:

The System provides a built-in sale process with step-by-step instructions for a manager. It allows to choose the most optimal tactics of interaction with a client at every stage of the process: from the analysis of demand and assessment of potential profitability of a legal entity to signing a contract.

One of the brilliant solutions in this bank CRM solution is its improved client’s profile, which now includes data gathered from social networks, history of previous interactions, financial indicators and so on.

Another attractive feature is a calculator of potential and factual weight of a legal entity, which is used to see all the opportunities for future collaboration.

Bpm’online is compatible with both desktop/laptop computers and smartphones.

SalesForce

The Salesforce cloud is a CRM suite offering, among all other products, CRM solutions for banks, and specialized for small and mid-sized organizations.

This product is equipped with functionalities for sales management, marketing automation, relationship management and customer service.

Salesforce is capable of synchronizing user’s data from MS Outlook (including calendars, contacts, tasks etc.) with its system.

The software is pretty handy for small companies giving advantages to automate contract management as well as to track performance.

This is realized through the built-in workflow (including approval process) and customs applications.

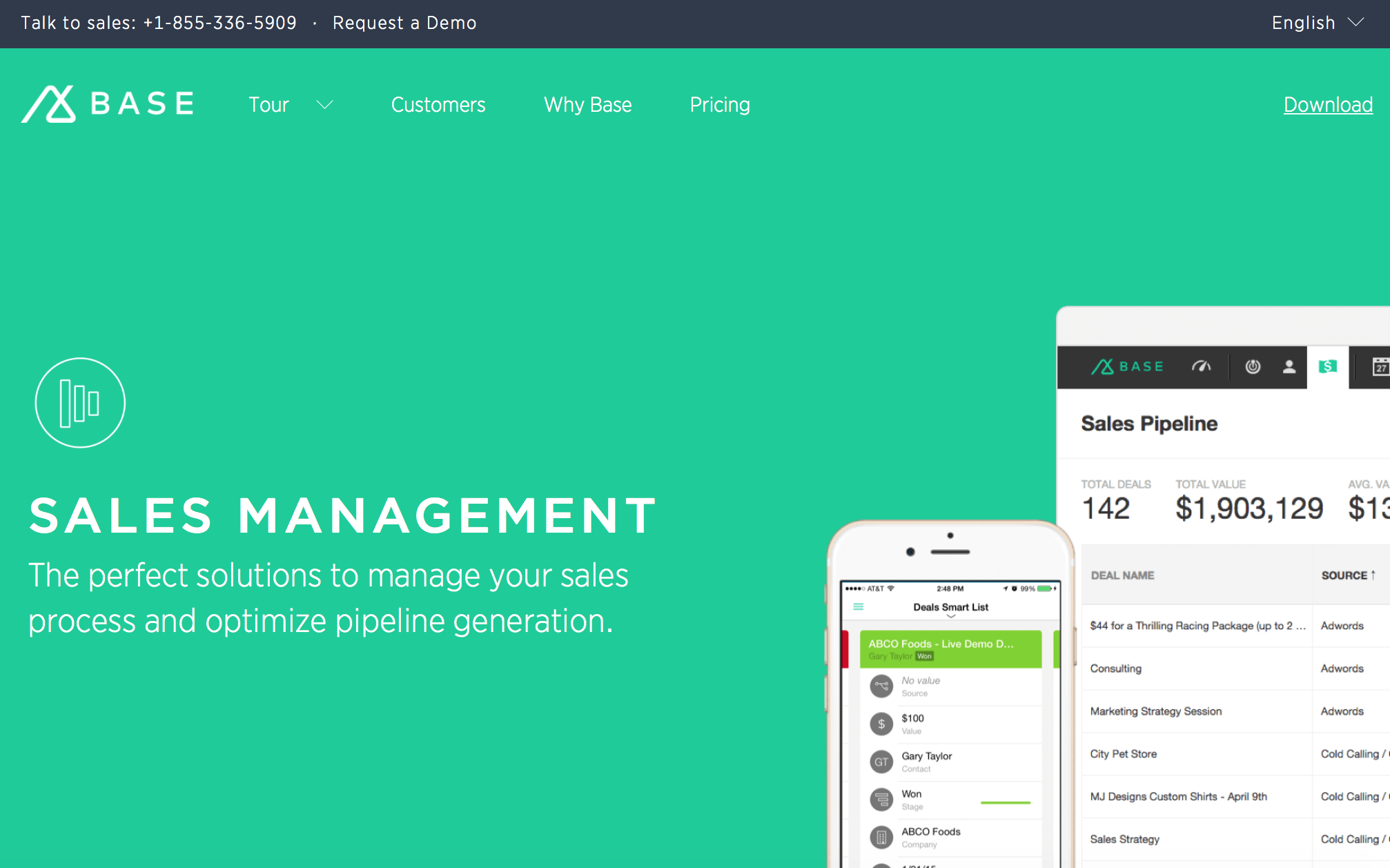

Base

The key advantage of Base application is that all fields can be customized to meet requirements of any banking institution. It gives the opportunity to track sales and visualize the status into the so-called ‘sales pipeline’ with out-of-the-box sales reports. The vendor provides a trial version free for two weeks and various options of product acquisition including attractive proposals for small companies.

CRM in banking and financial services are being rapidly developed. However, it’s important to realize the balance between the possible benefits received from CRM implementation and the associated costs and efforts. One can say for sure that banking CRM solution is not required for niche banks working with limited circle of customers. Such banks are not interested in enhancement of customer loyalty and in further business development and subsequently bank CRM system is not on the top of priorities for them.